Implementing a good structural revenue cycle management model in your healthcare practice is not enough if you don’t gauge its performance and effectiveness periodically against key performance indicators (KPIs). These metrics bring deeper insight into the “why” of the business problems, to map out the needed strategies for better earnings and revenue.

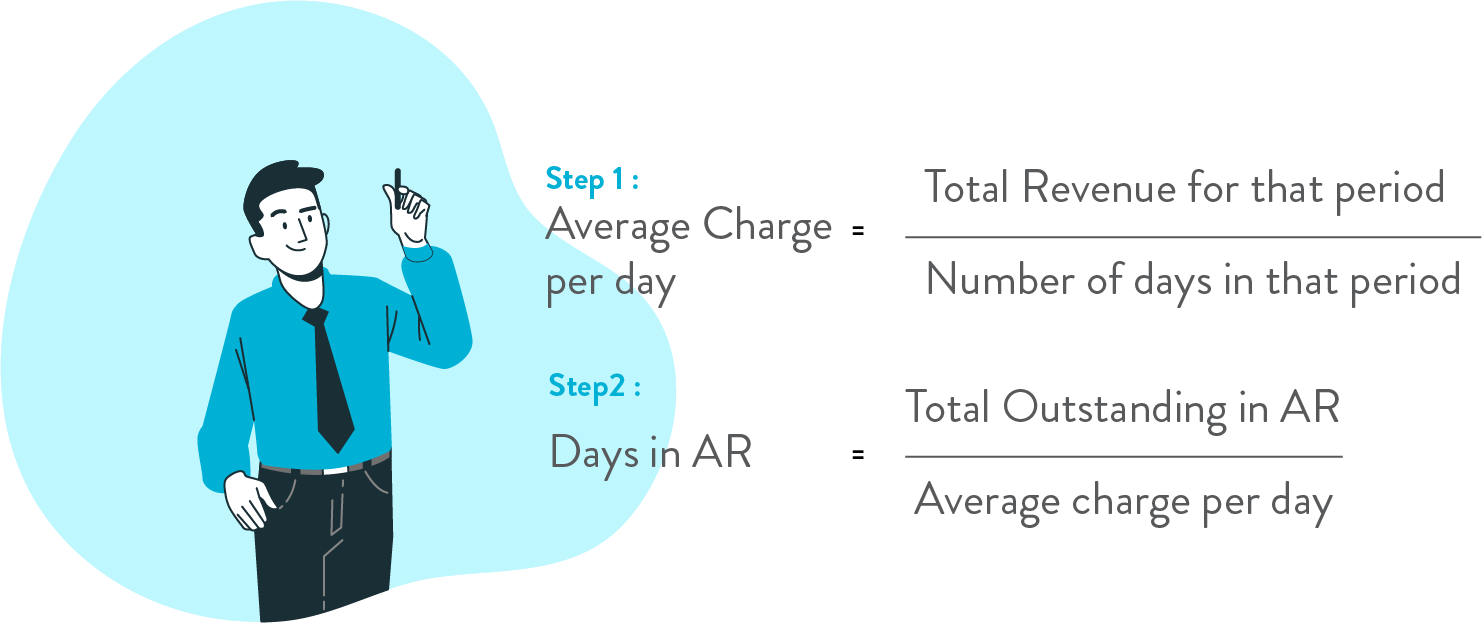

Days in AR

This reflects the effectiveness of the collection process in the RCM (Revenue Cycle Management) model. Account Receivables (AR) are your outstanding service bills. When you calculate days in AR, you get the number of days it takes to convert those ARs into cash or receive payment. Revenue is the total amount of money generated before any expense deductions. All the service charges or claims whether collected or not are counted in Revenue.

- Period should be the same for all calculations.

- Amount should be based on the date of service rather than the date of posting the claim.

The resulting number is the total days in which account receivables of your business receive payment. In general, 35 ≤ are considered as good, 35-50 as Average, and 50 ≥ poor. This range might be impacted by your specialty and payer mix. So, it’s preferable to compute AR days for each payer. It will give you a better view of where you need to put your attention to minimize days in AR and achieve more collection.

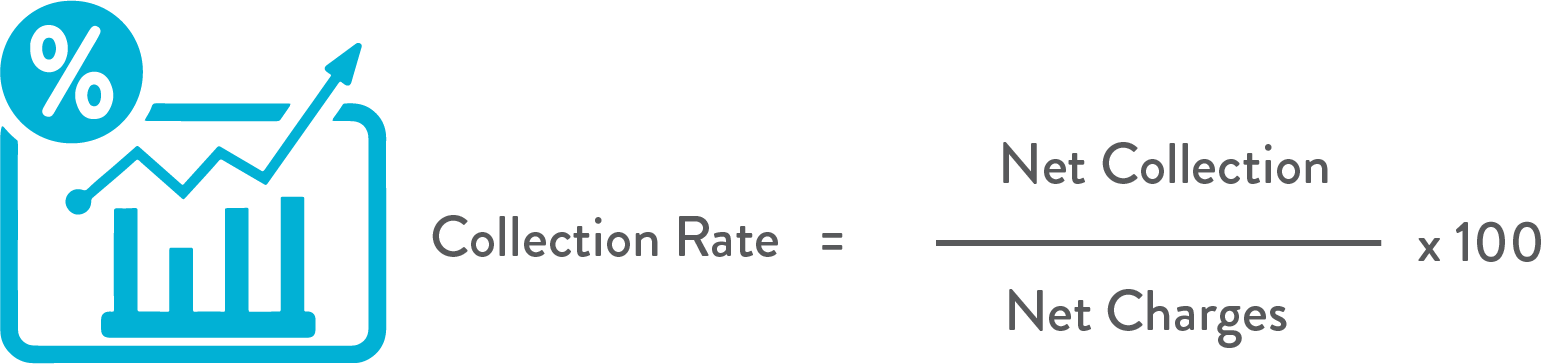

Collection Rate

The collection rate indicates the performance of billing process in your revenue cycle model. Net collection is the total payment received from payer and patient in a specified period. Net charges are the total amount charged by your office. To calculate Net charges for a particular period, you need to deduct all write-offs, discounts, credits, refunds, and other third-party or government adjustments from your total charges. Your net collection is always below your net charges, but the gap should be minimal.

or contact us to audit your RCM model.

The resulting percentage reflects how much of your charges actually turned into payment. Greater than or equal to 95% vouch for a good billing process, 90% – 94% point toward the scope of improvement, and below 90% indicates need for an audit of the billing process.

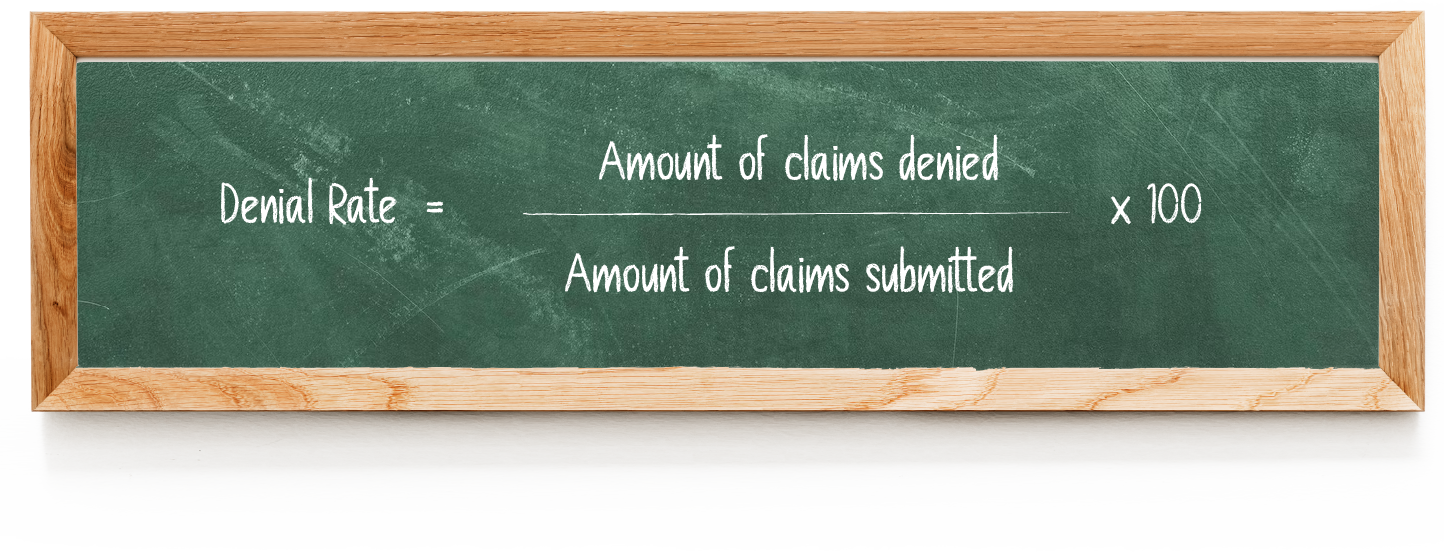

Denial Rate

The denial rate is the proportion of denied claims out of total claims submitted. Amount of claims denied is the total amount of claims denied by all the payers in a particular period. The aggregate amount of claims submitted for reimbursement in a given period is known as the amount of claims submitted. Periodic calculation of denial rate fosters trend analysis. Consider calculating it for each payer also, to identify problem areas in the claim submission process, i.e., whether the glitch was in demographic collection phase, eligibility verification, or coding.

The resulting percentage is the denial rate in your current RCM framework. The desirable rate is below 5%. Compare your denial rate with other providers in your area as it varies geographically. Sometimes economic variables also influence this percentage; as in the pandemic period year 2020, average denial rate had risen from 5% – 10% to 18.3 %. Denial rate over 10% indicates flaws in the RCM process and this can disrupt cash flow. Watch for frequent denial codes, for example, PO197 – No authorization, CO16 – lack of information in medical notes, CO29 – untimely filing; and strategize the process to remove those shortcomings.

Payment Variance

It is basically the difference between the total dollar amount of claims submitted for reimbursement and the actual payment received on those claims in a given period of time. This provides the future scope of revenue collection capacity.

Larger discrepancies between the expected and actual payment can be due to erroneous coding or insufficient documentation. Volume of variance cases is important rather than the amount of variance per case, as collectively that depicts the total loss of the business. This volume can be diminished with billing accuracy, aggressive contract handling, and better price negotiations.

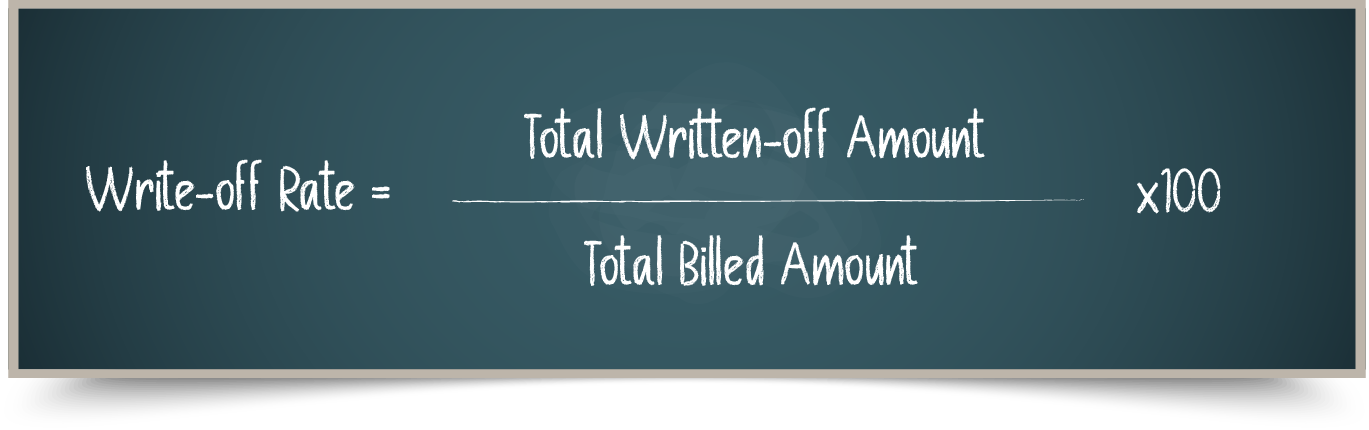

Write-off Rate

The write-off rate is the ratio of total amount of charges written off by net charges billed to patients or insurance companies. When AR becomes uncollectible even after exhausting enough efforts, providers have to write off that amount from their books after a certain period of time. In general, it’s when AR is idle for 120 days or greater. The write-off can be due to administrative reason, bad debts, payer deadline policy, or contractual.

The resulting percentage measures the effectiveness of collection process. The ideal RCM structure should not have more than 5%. Over and above 5% is a red flag signifying lower revenue generation against the capacity.

- Avoid taking gross charges into computation as it will give you a misleading figure.

Get your Free Comprehensive Medical billing & coding Analysis

OR

Reach out to our team to achieve 98-99% collection rate with our MedXP bundled service package. We have helped many providers reach the highest clean claim collection with reduced AR days and denial rate with our 99.3% coding accuracy.