What is days in Accounts Receivable?

Days in AR means average number of days a claim is outstanding before it is paid/reimbursed/collected.

It is a significant Key Performance Indicator (KPI) for a medical practice because, the higher the days in AR, the longer it takes them to get paid after providing care to the patient.

There is no particular Days in AR benchmark that applies to each specialty & it further depends on the practice’ payer mix as well. However, even before we get into analyzing benchmarks & formulating strategies, it is first important to know how to accurately calculate your days in AR.

Here’ how to calculate it: Take your total AR divided by the practice’s average daily charge amount. (For the average daily charge, divide total charges for the last three months by 90.3 days, representing three months).

For example, if your total outstanding AR is $350,000 & avg daily charge is $6200 the days in AR is $350000/$6200 = 56 days, meaning it is taking an avg of 56 days to get a claim/service paid. Clearly as an independent medical practice you do not want to wait 56 days to be paid for your service. Do you?

In this Article we will help you learn tips to effectively keep your days in AR in check & move towards a faster reimbursement regime

Tip #1: Move to a Front- End Driven Revenue Cycle Process

This involves performing some of your typical back end functions on the front end. Verifying insurance eligibility, requesting pre- authorization if necessary & patient liability estimation, when these are done on the front end, it gives patients the opportunity to pre-pay, cuts down the collection cost & reduces exposure to bad debt. Obtaining pre- authorization up front is a good practice to prevent rejected claims & helps keep days in AR under control.

Plan in advance for your end result!

Tip #2: Adopt Best Practices in Your Billing & Coding Management

We call this the preventive therapy! You need to prevent rejections, delays & denials to minimize the time to reimbursement & also minimize the lost revenue opportunities.

- From receipt of charges to submission of the claim, go for a 48 hour turn- around time.

- Set clean claim goals, make sure your billers and coders understand your goals & you have the right technology to be able to do so. Having a billing services provider who knows your goals is a big help. Aim for 97 % or more.

- Work your EDI rejections on a same day basis & collect data to further fine tune your claims scrubber/ rules engine.

- Use 100% certified coders.

- Do not use non-specific diagnosis codes, ICD 10 needs a lot more detail.

- Use appropriate modifiers

- Factor in payer guidelines while coding to say clear of rejections & denials

- Do not under code! Do not over code! Just code it Right!

Quicker you submit a clean claim to the right payer, quicker you get paid!

Download Now: 7 Key Elements of Effective Accounts Receivable Management White Paper

Tip #3: Manage Your Denials Effectively

Adopting best practices in billing & coding will help you minimize rejections & denials but not fully eliminate them. So, effective denial management is crucial to reduce your days in AR cycle. According to industry sources 50% of the denials never get reworked and this results in 5-7 % net loss of revenue.

- Create a well-defined list of CARC (claim adjustment reason code) & group them by similarity of further follow up actions.

- Some denials would need dispute/ appeal with the payer. Define your dispute strategy clearly. What is worthy of dispute VS what is acceptable, not every denial needs to be appealed on.

- The appeal success rate is highly dependent on the content of the appeal, having standard appeal templates with approved verbiage is a must.

- Use preventive denial analysis for the root cause study. The time & effort that goes into this exercise is totally worth it because it has the potential to reduce your future denial rate.

Tip #4: Understand and Define your AR Ageing Benchmarks Clearly

In the example above 56 days in AR does tell a story however it does not give you the full picture. First it does not talk about the patient & payer break up. Also, if the days in AR is higher than your expectation:

- Are all payers more or less in the same average ?

- Or is it because a couple of big payers from your payer mix are not paying claims on time?

Hence it is important to run detailed reports with payer break up to understand the overall ageing of your AR.

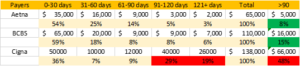

If you are looking at a report like this, it is very clear where your money is stuck & where do you need to focus.

- Define ageing threshold for each plan type from your payer mix & set clear goals. Medicare & worker’s comp can not have same thresh holds.

- Always compare your thresholds with the industry bench marks to ensure you are going after the right target.

- It is critical that your open AR has as minimum credit balances as possible. Having credit balances in the AR can throw off your calculations & mislead you.

- Monitor your ageing closely to see if the goals are being met.

- Look for trends of rejections/appeals/underpayments in your problem payers. If you can resolve issues in a batch it will save you time & money.

Tip #5: Perform AR follow-up and keep up your Follow-up Promises

If you have done all of above, then by now you should have a list of claims that need to be followed up on either with the payer or with the patient. You should also be able to set a priority level based on the above analysis & recommendations.

You have to really diligent with your follow up process to convert AR into cash-flow.

- Sort your payer follow up list, based on priority. The oldest claims & biggest $$ value would seem like two of the natural priorities. However, working on trends is also recommended as it may impact a lot of current as well as future claims.

- Define your no- response threshold & initiate follow up immediately on any claims outside of this threshold.

- Document all follow up to keep a track record, something that didn’t get documented, never happened!

- Develop well defined follow up actions with built in next follow up date. Make sure these are standard across the board.

- Create filters to identify follow up promises & stick to your follow up promises. It is critical in order to be able to close the loop on the case & resolve claims to bring in payment.

- Define a well-planned patient follow up process. This should include the timing & frequency of your patient statements. Enroll as many patients as you can for e- statements, people love to address issues on their handheld. Each statement should be followed by phone calls, define how many?

- Anything claims that are being sent to the collection agency, should be typically written off the books using specific codes.

Conclusion

As independent medical practices deal with the ever-changing financial environment, managing the accounts receivable efficiently is one of the most crucial aspects of managing a healthcare business. Cash- starved practices are the victim of a declining AR turnover rate & a deteriorating AR ageing schedule.

It is easier said than done, to turn around a troubled revenue cycle. You need to be able to determine what is wrong with the framework of your revenue cycle & then put together a workflow mechanism that will help you meet your goals & drive in the flow of cash.

By implementing best practices throughout your revenue cycle, you can substantially shorten it. By decreasing the payment cycle by 5-7 days the cash flow can increase significantly & it will allow you to run a successful practice.

Cosentus has helped many independent practices in not only successfully identifying gap areas but also implementing workflows that optimized their collections cycle & therefore tremendously improved their cash-flow.